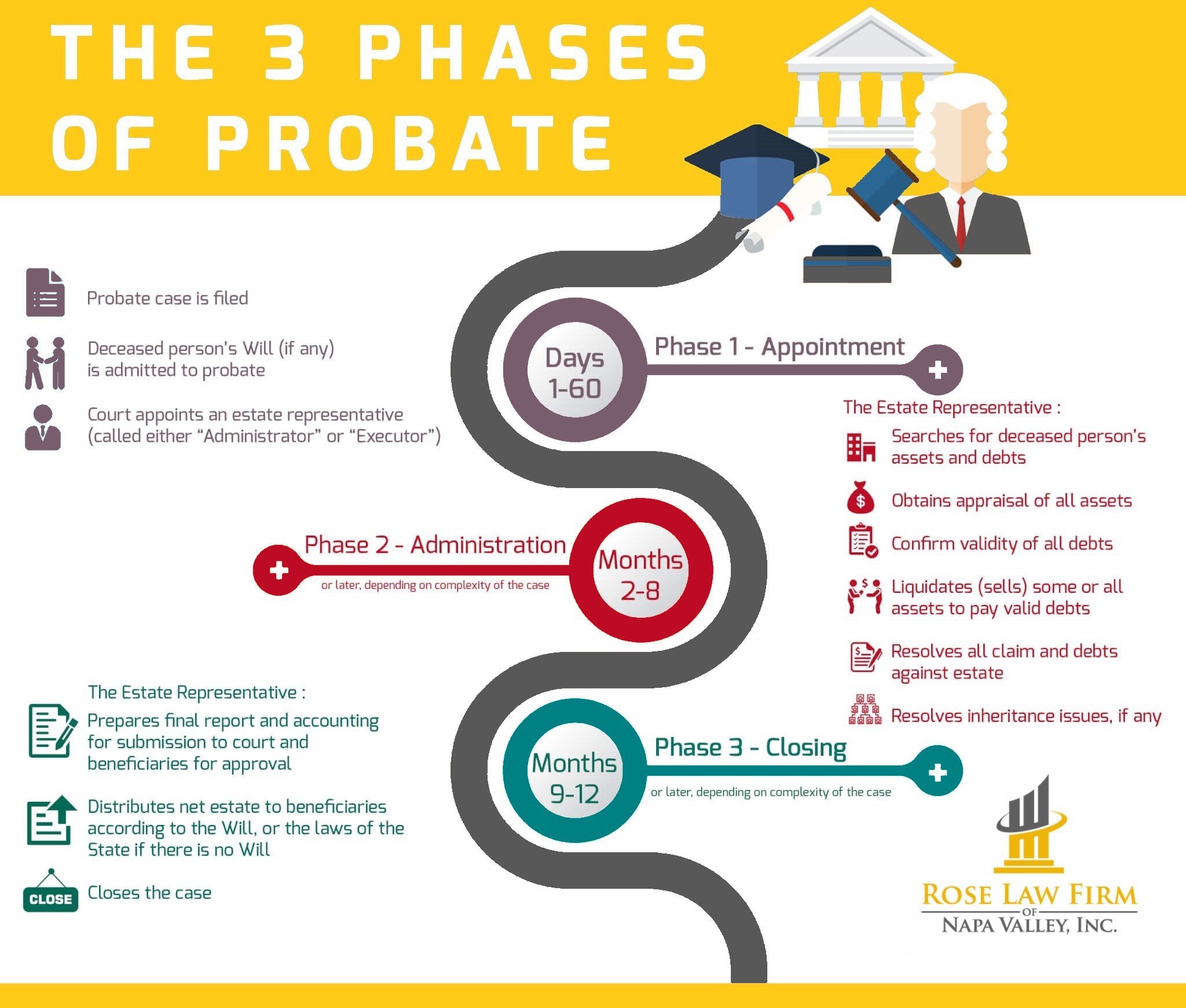

A: If probate is necessary, someone must come forward to start the probate process, which generally lasts six months to a year and consists of three main phases: 1) Appointment of the executor/administrator; 2) Administration of the estate; and 3) Closing of the Estate, as shown in our Infographic below.

The primary goal of Phase 1 is to give the “executor” named in the will (or the “administrator” if there is no will) the legal authority to act on behalf of the Decedent. This is primarily legal work (a lot of court forms to file and court rules to follow, notices, publications, at least one court hearing, etc.) and the probate attorney usually takes care of this on the executor/administrator’s behalf.

During Phase 2, the executor/administrator will start to search for and gather all of the Decedent’s assets as well as confirm the validity of all Decedent’s debts. Moreover, tax returns will need to get filed, assets will need to get appraised, some/all assets will need to get sold, all valid debts will get paid, all issues, disputes, and/or claims will need to be resolved. During this phase, it’s the responsibility of the executor/administrator to safeguard and manage all the estate assets.

Finally, when all bills and taxes have been paid, Phase 3 begins and the probate process is brought to an end by requesting that the court formally close the estate and authorize the executor/administrator to distribute all the estate assets to the beneficiaries/heirs of the estate. Phase 3 is mainly legal work that the probate attorney takes care of on the executor/administrator’s behalf.

If you have any questions about this, please feel free to reach out to us (707-681-5851 or [email protected]) or set up a complimentary consultation at your convenience by clicking on the following link: https://MyNapaLawyer.as.me/